Detect fraudulent borrowers with AI

With more than 150M documents analyzed, Resistant AI is the industry-leading document fraud detection system for your loan underwriting process.

Verify fake or fraudulent lending documents from PDFs and images, for a strong loan fraud prevention.

With more than 150M documents analyzed, Resistant AI is the industry-leading document fraud detection system for your loan underwriting process.

Verify fake or fraudulent lending documents from PDFs and images, for a strong loan fraud prevention.

Detect fraud invisible to the human eye with AI

Protect every stage of the lending journey and minimize fraudulent applications and default risks, with an AI-powered document fraud detection and transaction monitoring system.

1. Quickly analyze documents used in loan applications to detect fraud invisible to the naked eye.

2. Check for fraudulent behavioral patterns in real-time, and manage risks across your entire loan underwriting operations.

Assess your fraud risk in real-time

Easily and quickly identify forged or manipulated documents, a common tactic used in credit fraud and fraudulent loan applications.

With AI and machine learning, we automatically detect even subtle alterations in all types of documents (bank statements, tax forms, invoices, IDs, business registrations, etc.), so you can catch fraudulent submissions before credit or mortgage is extended.

Integrate it with your underwriting system

Resistant AI supports both automated and manual underwriting, seamlessly integrating into your existing loan origination and processing systems.

Start detecting fraudsters immediately with our drag and drop web interface, or deploy our API when you're ready to automate your fraud checks

Resistant AI has helped us to drastically reduce both the time it takes to catch fraud, and the amount of fraud that makes it past us to lenders.

- Ryan Edmeades MLRO and head of financial crime

Resistant AI has significantly helped prevent specific types of credit fraud, and enhances our ability to defend against document fraud attacks.

- Petr Volevecký Head of Credit Fraud Risk

Probably the best tool in our review flow. Resistant are our bionic eyes.

- Katarina Demchuk Identity Verification PM

Resistant AI perfectly complement FINOM's AML and Anti-Fraud program with its explainable AI, ensuring transparency to AML analysts as well as the regulator.

- Sergey Petrov Co-founder, COO

With Resistant AI, we can manage our known risks more efficiently while also identifying and adapting to previously unknown risks.

- Valentina Butera Head of AML & AFC Operations

Resistant AI prevents the manipulation of invoices submitted to our marketplace. It allows out investors to trade in security and saves my team a huge amount of manual work.

- Alexandra Belková Head of Operations

See how we detect documents that are created with AI

Get the real time fraud detection system used by modern banks

Modern banks and other lenders use Resistant AI to check the document's metadata, internal structure, image consistency, backgrounds, fonts, and more.

You can now confidently detect fraudulent documents and suspicious behavior in loan underwriting, and lower your credit risk.

Your TOP fraud prevention strategy

As mortgage fraud cases rise, we understand that your clients rely on your due diligence and integrity in processing every corporate loan or home mortgage approval.

Whether you're handling manual underwriting for home loans or managing an automated underwriting system, our solution scales to meet your needs, offering added layers of verification for lending APIs and mortgage servicing platforms alike.

Failing to detect fraudulent applications can have serious consequences

Upgrade your financial risk management solution and prevent fraud before it happens, safeguard your reputation, decrease your risk of default & financial losses, and avoid legal liabilities & regulatory penalties.

Enhance your overall risk management framework, and ensure compliance with industry regulations.

And your fraud risk scales as you do

The bigger your company is, and the simpler your loan origination process is, the higher the risk of fraud.

In a world where the financial sector is increasingly reliant on AI in banking, Resistant AI's solutions lead the way in innovation, ensuring you stay ahead of evolving fraud tactics as a bank, mortgage lender or mortgage broker.

Protect your loans from document fraud today

We help financial institutions combat corporate and consumer credit fraud, such as B2B lending fraud or mortgage fraud, and strengthen their underwriting process.

Resistant AI’s document fraud detection empowers your team to stay ahead of evolving fraud schemes with confidence.

See how much you can save:

- Average out-of-the-box detection rate (pre-training) 86%

- Average reduction in manual reviews 92%

Ready to take your lending fraud detection to the next level?

Loan fraud occurs when someone provides false information or conceals facts to obtain a loan they would not otherwise qualify for. This can include identity theft, falsifying income or employment details, or misrepresenting the purpose of the loan.

Lending fraud leads to reputation damage and financial losses for lenders. That is why modern and forward-looking lenders use Resistant AI to automatically detect fraud during their loan and mortgage underwriting process.

An automated underwriting system is a software that evaluates loan, mortgage or other lending applications using algorithms and data analysis to assess risk and eligibility automatically. It streamlines decision-making by analyzing factors like identity, credit history, income, and other criteria, reducing the need for manual review and speeding up the approval process.

Adding Resistant AI as a fraud detection layer to your automation is essential though, because if you're automating your document intake without fraud prevention, you're automating fraud.

Resistant AI is transforming the mortgage industry by improving efficiency, accuracy, and customer experience.

- Document Fraud Detection: Resistant AI analyzes all documents used in mortgage applications, in all languages, and in PDF or image formats. It verifies if the documents provided are authentic and if they haven't been modified.

- Behavioral Analysis: Resistant AI analyzes patterns in loan applications and transactions to identify anomalies or potential fraud.

- Automated Underwriting: Lenders use Resistant AI to evaluate borrower risk using real-time data, streamlining credit decisions, decreasing screening cost, and ensuring consistency and confidence in decisions.

- Document Processing: Lenders automate the verification of loan documents, spotting fraud that is invisible to the human eye, and reducing manual errors.

- Compliance and Risk Management: Resistant AI helps banks and other lenders ensure regulatory compliance by monitoring and flagging potential issues in real-time, minimizing legal and financial risks.

To spot fraudulent mortgage applicants with Resistant AI, digital lenders first verify the identity of the customer as part of the KYC or KYB process, spotting forged or altered documents, detecting face spoofing, and finding suspicious behavioral patterns. They usually check:

- IDs

- Utility bills

- Bank statements

- Selfies

- Certificates of incorporation

- Business licenses

- Suspicious transactions

Once the borrower submits an application for a loan, the lender verifies their creditworthiness and financial health, usually checking:

- Pay stubs

- Bank statements

- Tax forms or tax returns

- W-2 Forms

- Invoices

- Contracts

With Resistant AI, they can automate their fraud detection capabilities, streamline their processes, lower their operating costs, and ultimately detect more fraud, faster.

Avoiding mortgage fraud requires vigilance, due diligence, and adherence to best practices. Resistant AI helps you streamline the whole process, lower underwriting costs, and spot more fraud, faster.

- Verify Documentation: Scrutinize all submitted documents, including income statements, tax returns, and identification, for inconsistencies or alterations.

- Use Automation: Employ our AI-driven fraud detection systems to identify red flags, such as fake documents or suspicious patterns.

- Perform Background Checks: Conduct thorough checks on borrowers, appraisers, and third-party agents involved in the transaction.

- Monitor Transactions: Implement strict monitoring protocols to detect unusual behavior, such as frequent address changes or suspicious transactions patterns.

It takes less than 20 seconds on average for you to get your verdict when analyzing a document for fraud with Resistant AI.

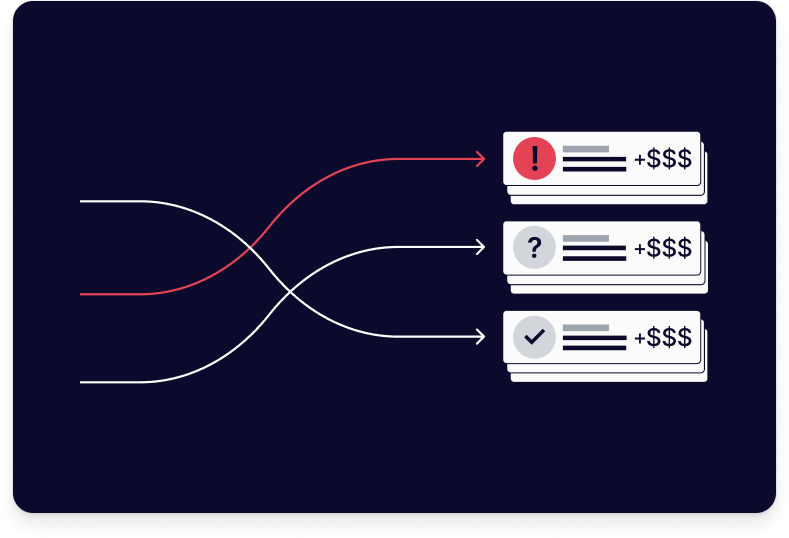

We don't believe in risk scores: What do you do with a 68% vs an 82% document risk score?

Instead, Resistant AI gives you clear actionable verdicts:

- High Risk: this document is likely fraudulent and should be declined.

- Warning: this document is modified and should be reviewed.

- Normal: there’s nothing wrong with this document and can be accepted.

- Trusted: this document perfectly matches authentic ones.

You can either use Resistant AI manually by dropping documents in our web interface, or use our API integration to automate fraud detection at scale.