Webinar Q&A: Gen AI fraud & OnlyFake

You will find on this page the answers to all the questions you asked during and after our webinar on generative AI document fraud and OnlyFake. We hope you find them useful.

Should you have more questions or want to see a demo of our document fraud detection solution, don't hesitate to click on the button below.

How could a fraudster use AI technology to provide an image of them holding the ID next to their face? Could this image also be AI?

How can fraudsters bypass the liveness check (e.g. face scan)? Can they bypass the video verification by using AI?

Yes. This entirely depends on the sophistication of the liveness detection:

- Static ones—where a person takes a selfie while holding the ID card or a paper with the onboarding date or a provided code—can easily be fooled by readily available Gen AI image generating models.

- Video verifications can also be fooled, though with slightly more complicated deepfaking technology that overlays and replaces facial features, either on a prerecorded video—if the liveness check follows a static request pattern (look left, up, right, etc)—or by in the video stream itself.

- Depth scanning verifications—think of the iphone’s FaceID, which creates a 3D map of the face—are likely the most difficult to fool. However, unlike the first two options, this isn’t a universally available technology, which dramatically limits.

However, one clever way to bypass all of them is for a fraudster to use their own portrait (or that of a paid mule) on the ID, since the liveness will then perfectly match their face.

Can AI identify if filters are being used to take a selfie & use the image with the filter and place it on an ID card?

Have you seen fraudsters overcome selfie capabilities with Gen AI?

We've come across multiple different tactics, including:

- Replacing the portrait on the ID to match the person who will be passing the liveness check

- Modifying the face of the person passing the liveness check to match the photo on the ID, either in a live video stream or on a static selfie.

- Modifying the face on both the ID and the person undergoing the liveness check.

Are there any languages that LLMs can't use to create fake profiles?

No. Large Language Models can operate in any language. The quality might vary depending on the training of the model, but they are pretty proficient in any language.

What are the most common countries that are using these types of software to create fake IDs, and also what are the countries they are using on the IDs/Documents?

Can you please share a few more examples of non-ID documents that you've worked with? And markets you've worked with those types of documents?

We are document agnostic, meaning we don’t really care what the document is. So long as it’s a document in digital format (PDF or Image), we can analyze it for fraud. That means we can analyze tax forms, business registration documents, bank statements, utility bills, income statements, paystubs, diplomas, etc… We have analyzed over 100M documents from over 130 countries.

If you had to predict, what kind of regulatory requirements will come down (E.g. in the USA)?

Potential regulatory requirements might be to:

- Ensure there is no discrimination against those who are unbanked, not Plaid-enabled, meaning forcing institutions to accept documents even when they would rather not.

- Ensure that any decisions made about a document, whether it was approved or denied, is clearly recorded for future audit.

What document types can be checked for fraud?

Resistant AI is document agnostic. That means it works with any document loan underwriters use, from anywhere—even those we've never seen before. That includes tax forms and other tax documents, bank statements, pay stubs, account statements, IDs, passports, invoices, and more.

What document formats do you support?

Resistant AI works with all PDF and image formats. Different formats have different risk profiles, and we can help you set up a policy that matches your risk appetite.

Could we run a check on past documents to get an idea of our "leakage" in the past? How does it work technically?

Yes, we do this kind of retroactive analysis often with our customers—often finding far more fraud than they knew about. This kind of past check is best run through an offline batch upload to our API. Book a meeting to get started.

With the current anti-fraud programs it all seems very reactive, do you see a future where Gen AI could be leveraged to proactively predict scams?

Not necessarily Generative AI, as its purpose is to generate content, and perhaps bring some contextual understanding of content through its ability to explain things. With the exception of reading spam/scam messages and classifying them as such, the actual predictive and preventative capabilities to stop other types of fraud would be handled by other forms of AI. Generative AI might play a role in explaining the output of those other AIs.

Have you seen any University Transcripts and Final Award certifications?

Yes. We work with several institutions that can approve student visa applications and also background check companies, where transcripts and certifications come up.

Would duplicates of previously reviewed documents be identified? I'm thinking about bank statements copied with limited changes (e.g. different persons, same transactions).

Would you consider the onboarding on crypto asset platforms particularly vulnerable to these false documents? Have you seen an increase in attacks against this sector?

While crypto asset platforms are vulnerable, we find that any financial service that allows people to open accounts (banks, payment firms, etc) are particularly at risk to false documentation, as it enables organized criminals to commit many more crimes—from receiving the proceeds of scams and fraud perpetrated elsewhere, to money laundering without the need for or risk from real money mules, building up fake credit scores for bust out frauds, or just reselling those accounts as valuable commodities to other criminals.

Have you seen the AI and fake document usage in the B2B industry, like corporate docs? And, if so, would you be able to share the experience?

What is the difference between Gen AI identifying a fake document and other IDV solutions not using AI?

In our case, we do not use Gen AI to identify fake documents. Rather, we detect fake documents created by Gen AI. We also do not consider ourselves an IDV: we can verify more documents than just IDs, and while in our experience we do a much better job of detecting fraudulent documents than IDVs (and count some IDVs as resellers of our service behind the scenes), we do not do many of the other checks IDVs provide (including liveness checks, database lookups, etc). We specialize in checking the documents for fraud—and aim to be the best at that.

Can AI generated images somehow be identifiable from the eyes of an individual?

Only if poorly made. Today, most regular document fraud done digitally cannot be detected with the human eye. Bad AI is only making the problem far worse. Frankly, the arms race has begun, and there is no going back: if humans even had a slim chance against the quality of fraud produced by AI, they certainly don’t against the scale and speed at which it can be created. And things are only going to get worse as the bad AI improve. They need good AI to back them up.

How can organizations effectively integrate human judgment and AI-powered tools to detect and prevent fraud while minimizing false positives and ensuring compliance with regulatory requirements?

From an integration perspective, is it a SaaS service in your cloud or can it be deployed in the partner's/customer's cloud?

We offer several different models. We offer several different deployment models, including deployment in partner/customer clouds under specific configurations. If you’d like to discuss in more detail, schedule a quick call with our team.

Is your ability to detect false documents limited when the document is a scanned copy? Or do you require the document’s original metadata? Would it be able to detect screen grabs (copies) of the generated document?

It largely depends on the individual document and fraud execution. Generally speaking, we have detectors that work on images in all formats, including scans, screenshots, and photos amongst others. We're also able to rank different formats and document types by risk, and help you build an appropriate intake policy that will match your risk appetite. To learn more, book a call.

How can I tell when a document is fraudulent?

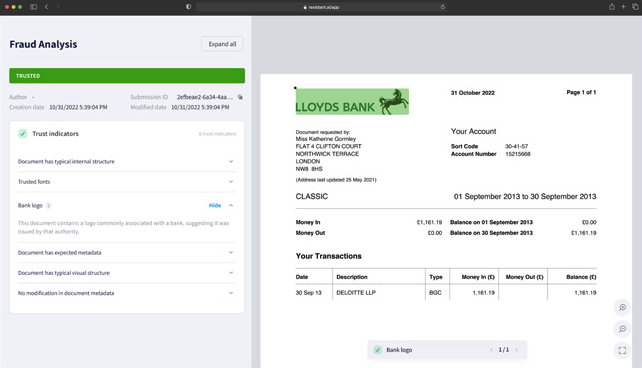

We don't believe in risk scores: What do you do with a 68% vs an 82% document risk score?

Instead, Resistant AI gives you clear actionable verdicts:

- High Risk: this document is likely fraudulent and should be declined.

- Warning: this document is modified and should be reviewed.

- Normal: there’s nothing wrong with this document and can be accepted.

- Trusted: this document perfectly matches authentic ones.

How do you balance the need to let good customers through while protecting against a threat that's constantly evolving?

How can I use Resistant AI?

You can either use Resistant AI manually by dropping documents in our web interface, or use our API integration to automate fraud detection at scale.

How useful is the metadata of the documents? How often do you see it modified?

What strategies can organizations implement to stay ahead of the evolving threat of Gen AI document fraud?

- In dealing with AI Generated document fraud, you need AI-powered document fraud detection. You need good AI to fight bad AI.

- Taking a layered approach to detecting fraud. The document is just one element of any fraudulent attack. Having other data-driven anomaly detections that look at behaviors, transactional patterns, device biometrics and more will reveal other elements.

- Having a defense in depth approach, where detections on one layer get used to reinforce the other layers.

Is there a "good practice" suggestion of pairing Resistant AI with an IDV vendor to verify documents and identity?

In what languages can Resistant AI analyze documents?

Resistant AI analyzes documents in any language. In fact, we don't read the content of the documents to catch fraud—we analyze the whole context of how the document is made instead. Simply put, we look at how the words are written, not what they say.

How does Resistant AI scan documents for fraud?

We analyze every document over 500 ways for signs of tampering or fraud to ensure high precision on our verdicts. That includes internal structures, image inconsistencies, fonts in use, metadata analysis, visual similarities, etc. We then compare all incoming documents to find document reuse, template farms, and high-scale fraud attempts.

How serious is document fraud in digital lending?

By analyzing millions of documents every month, we've found that 1 in 5 documents used in digital loan applications show signs of tampering, and up to 2% of documents are based on reused or generated documents indicative of crowd-sourced first party fraud or organized crime rings.

Does Resistant AI work for commercial credit underwriting?

Yes, you can analyze any and all documents necessary for the lending underwriting process: From tax forms and other tax documents, to bank statements, pay stubs, account statements, IDs, passports, invoices, and more.

How long does it take for Resistant AI to review a document?

It takes less than 20 seconds on average for you to get your verdict when analyzing a document for fraud with Resistant AI.

How much would you charge for us to drag and drop documents on your website if we have a small business?

What is the best way to reach you for a private discussion?

Detect document fraud the human eye can’t see

We check the document's metadata, internal structure, image consistency, backgrounds, fonts, and more, so you can confidently detect fraudulent documents in business loan underwriting.

.png?width=465&height=315&name=DocumentDetection%20(1).png)

Scan any document, in any language in PDF or images

- Tax forms

- Bank statements

- Invoices

- IDs & passports

- Business registrations

- and more...

Simply drag and drop your file or deploy by API

Start detecting fraudsters immediately with our drag and drop web interface, or deploy our API with just 14 lines of code when you're ready to automate your fraud checks.

See how we detect documents that are created with AI

Chosen by forward-looking financial services

results

Ready to prevent fraud?

524 Broadway

New York, NY 10012

United States

53-64 Chancery Lane

London, WC2A 1QS

United Kingdom

13/8 Lazarska

Prague, 12000

Czech Republic